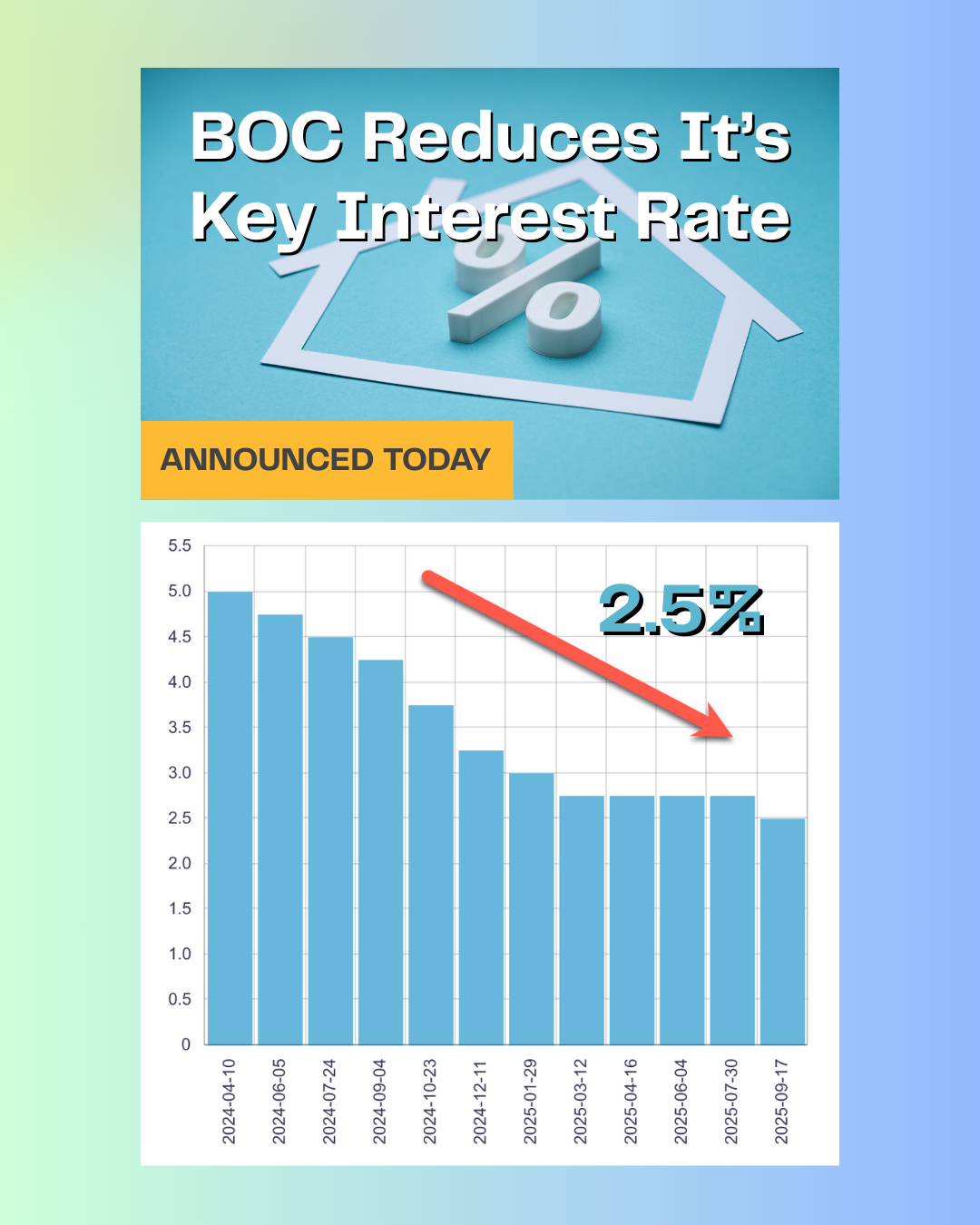

The Bank of Canada has just lowered its key interest rate again — from 2.75% down to 2.5%.

What does that really mean for you?

Borrowing just got cheaper. Mortgages, loans, and lines of credit could see some relief.

The Bank is nudging us to spend. Lower rates are meant to give the economy a little more fuel.

Opportunity is knocking. For buyers, this may improve affordability. For homeowners, it could be a chance to revisit your mortgage strategy.

Of course, no one knows precisely what’s next — but the direction is clear: the Bank is working hard to keep money moving and the economy steady.

The real question is: how can you make this move work for you?

Comments:

Post Your Comment: